capital gains tax increase news

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021. To increase their effective tax rate.

2021 And 2022 Capital Gains Tax Rates Forbes Advisor

The amount of tax levied on capital gains could be raised by billions of pounds according to a new report.

. Bidens proposed capital gains tax increase could generate up to 1 trillion in revenue in the next decade. Long-term capital gains are taxed at lower rates than ordinary income and how much you owe depends on your annual taxable income. Under the proposed Build Back Better Act the top marginal tax rates will jump from 20 to 396 That is a steep hike even for the wealthiest.

Thats according to a new study published by the Tax Foundation which found that Bidens plan to raise the federal capital gains tax rate to 396 from 20 for households. In the state of Washington the governor has proposed a capital gains tax that could raise almost 1 billion if passed. When including unrealized capital gains as income the households effective tax rate is 12 percent below the proposed 20 percent minimum.

Under President Bidens proposal the highest tax rate for capital gains would increase to 396 up from a top rate of 20 currently. In an effort to tax wages and wealth at the same rate Biden wants to put the top income tax rate at the Obama-era 396 and also have the same 396 capital-gains rate. The highest long-term capital gains rate would rise to 25 while the 38 Medicare surcharge for high-income investors would push that rate to 288.

2 days ago21 May 2022 - 0400. One of the changes announced was in April 2018. House Democrats on Monday proposed raising the top tax rate on capital gains and qualified dividends to 288 one of several tax reforms aimed at wealthy Americans to help fund a 35 trillion.

It was announced that long. Romney says Trump was right to not cut capital gains taxes. Capital Gains Tax Rate Update for 2021.

Capital gains tax The Democrat-led state Legislature approved a 7 tax on capital gains over 250000 early in the year. To provide the most recent info on capital gains taxes. Long-Term Capital Gains Taxes.

But because the higher tax rate as. The Biden administration recently released plans to increase the top capital gains tax rate for people earning over a million dollars a year to help pay for his American Families. About 14bn could be raised by cutting exemptions and doubling.

The Biden administration has proposed an increase in the current favorable capital gain rates for people earning more. Capital Gains Tax Rate Set at 25 in House Democrats Plan Rate would rise from 20 under House panels proposal Biden had wanted to boost rate to 396 for highest earners. Proposed capital gains tax.

News Analysis and Opinion from POLITICO. While it technically takes effect at the start of 2022 it. One of the changes announced was in April 2018.

Major income tax changes in last 10 years and how they have impacted your investments. The underlying tax proposal is a hike in the capital gains tax from a top rate currently of 238 percent to 434 percent which is set to equal a simultaneously raised top rate. You will pay twice more in terms of taxes on property sold if the proposed increase on Capital Gains Tax in the Finance Bill 2022 is adopted as it is.

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Top Personal Income Tax Rates In Europe 2022 Tax Foundation

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Capital Gains Tax Advice News Features Tips Kiplinger

Any Gain That Arises From The Sale Of A Capital Asset Is A Capital Gain This Gain Or Profit Is Comes Under Th Capital Gains Tax Capital Gain Financial Peace

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

Capital Gains Capital Gain Accounting And Finance Finance Investing

Capital Gains Tax Advice News Features Tips Kiplinger

Your Ultimate Australia Crypto Tax Guide 2022 Koinly

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

Selling Stock How Capital Gains Are Taxed The Motley Fool

How Does The Personal Representative Deal With The Income And Capital Gains Arising After The Deceased S Death Low Incomes Tax Reform Group

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

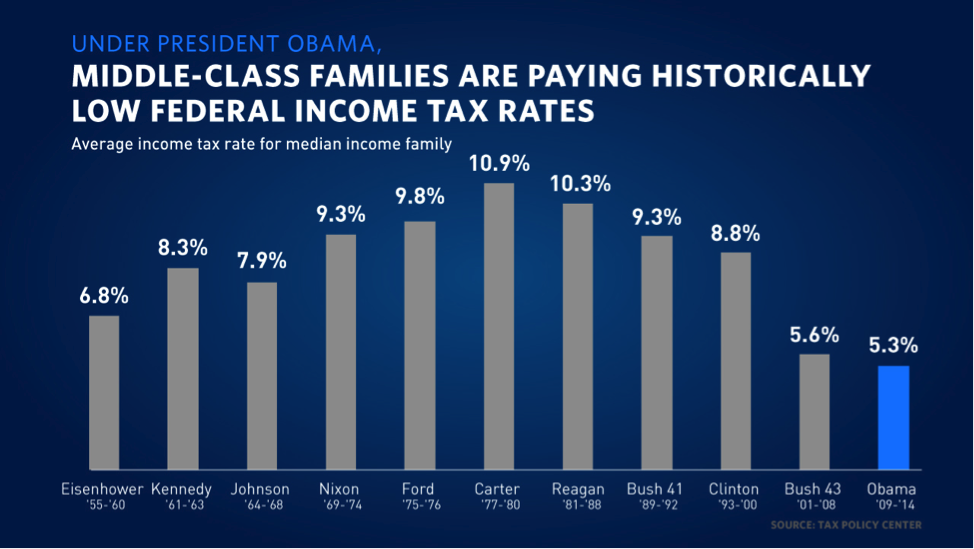

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)